Donor Advised Fund

Start Giving Today

Save more. Do more. Give more with a DAF.

Are you looking for ways to make a financial gift to ministry? A donor advised fund (DAF) is a great way to give! Through a DAF, you can grow your charitable gift, enjoy flexible giving options, minimize fees (including a fee-free option), and WatersEdge handles the paperwork. You also receive a charitable income tax deduction this year and can decide where to send your gift at a later date.

Key Benefits

Enjoy Ultimate Flexibility

Contribute cash, stocks, property or other assets at your convenience. Make gifts as often as you like.Reap Tax Advantages

Contributions are immediately tax-deductible. You’ll pay no capital gains tax on donations of appreciated assets, including stocks and real estate.

Simplify Your Giving

Contributions are invested and grow over time to maximize charitable impact. All growth is tax-free.

Reduce Fees with WatersEdge

There are no fees to open an account or process gift requests. Management fees are waived for select investments.Start Here

Our experienced staff at WatersEdge will guide you through the process so you can support charitable causes you care about – at the click of a button.

CREATE AN ACCOUNT

The online process is quick and easy.

FUND YOUR DAF

Transfer assets to your account.

MAKE GIFTS

When you’re ready, tell us where to send the money.

Can I Use My DAF For That?

Though there are some restrictions for making gifts (grants) from your donor advised fund, you can support any active, qualified charitable organization with a 501(c)(3) designation as well as your church. Remember that your gift must be entirely charitable and cannot provide you or your household with any direct or incidental benefits. We’ve created the guide below to help you know when you can — and can’t — use your DAF to make a gift.

Your church (tithes, offerings, building campaigns)

Southern Baptist/faith-aligned ministries

Special offerings (Lottie Moon, Annie Armstrong, state missions offerings)

Missions organizations (IMB, NAMB, etc.)

Disaster relief (Southern Baptist Disaster Relief, Send Relief, Samaritan’s Purse, Red Cross, etc.)

Universities and seminaries

Food banks and shelter ministries

Any nonprofit recognized by the IRS as a 501(c)(3) organization

Political parties, PACs, candidates running for election

Tickets to a charitable event or benefit (dinners, banquets, golf tournaments, auctions, sponsorships)

Dues, membership fees or pledges

Gifts that provide private benefit to you or any other individual

Private foundations or non-functionally integrated “Type III” supporting organizations

Organizations whose mission is incompatible with WatersEdge social screens

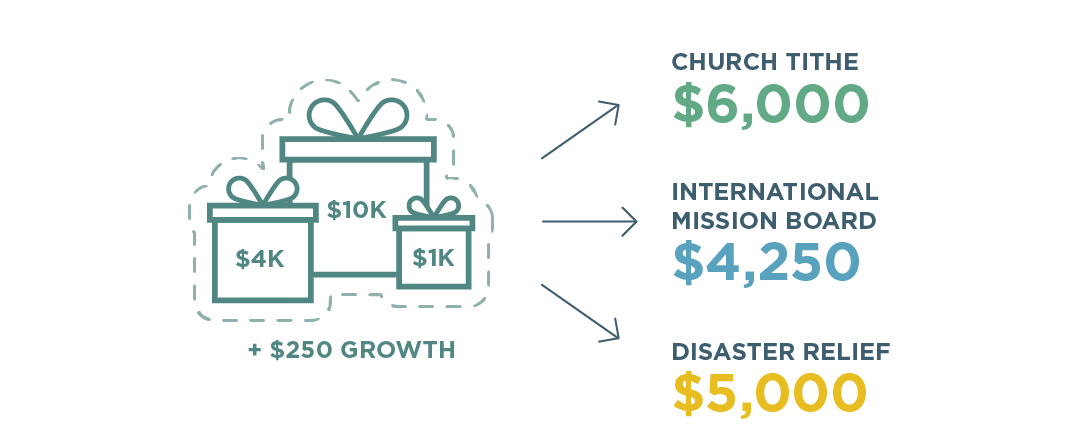

Giving Example

The Robinsons started a DAF with WatersEdge using $10,000 in stocks, $4,000 in private equity and $1,000 in cash, and received an immediate tax deduction. The money was invested and earned an additional $250 while the Robinsons decided which ministries they wanted to support. When they were ready, the Robinsons gave grants from their DAF to their church, the International Mission Board and disaster relief. WatersEdge sent all the checks and, at the end of the year, sent the Robinsons a summary of their DAF giving.

A Donor Advised Fund May Be Perfect If:

You want flexibility and convenience in giving.

You want contributions to grow over time.

You need an immediate tax deduction.

You want to contribute appreciated assets.

You want a trusted advisor to track your gifts for tax purposes.

You want to manage all charitable giving through a single account.

“Most people are waiting for some big reason to give. People think, ‘Well, it’s small. It doesn’t matter.’ But everything matters. If it’s a gift the Lord told you to give, then give and be obedient. You’re not going to get to those big things until you’re faithful with the small things.”

Greg & Susan Kannady

Donors | Kingfisher, Oklahoma

Go Deeper

Tax Impacts

People who itemize maximize tax benefits by receiving an immediate tax deduction that can potentially benefit them for five filing years. Even if no grants are made immediately, donors are eligible for an immediate tax deduction upon funding the donor advised fund. Funding your DAF with appreciated securities can help you to eliminate capital gains tax.

Every time you fund your DAF, you will receive a receipt, and you don’t have to keep up with what charity receives the grant. When it comes tax time, instead of having to gather all of your own receipts, you will be able to view all giving statements in the online platform; you will also receive an annual giving summary.

Fees

There are no fees to open an account or process grant requests. You can choose from funds with no management fees or other DAF investment options with low management fees. WatersEdge uses a tiered fee structure based on your DAF’s average daily balance, where you will be charged monthly out of an annual fee. Each charge is 1/12th of what you can see on the fee structure below. There are no fees related to a minimum account balance.

The tiered structure is as follows:

- First $250K: .75% of balance

- Next $250K: .60% of balance

- Next $500K: .35% of balance

- Over $1mm: .20% of balance

Minimums

- DAF minimum account funding is $1,000.

- Minimum funding for Advisory DAFs is $100,000.

- When making grant recommendations, grant minimums are $250.

- There is no minimum balance amount.

Investment Options

All investments are socially screened and there are prohibitive restrictions placed on investments in alcohol, tobacco, cannabis, pornography, gaming, abortion, embryonic stem cell research, payday loan practices, human trafficking, and forced child labor.

You have the option to diversify your investments in the following:

General Investment Pool – The General Investment Pool is managed by the WatersEdge Board of Directors and invests in a wide range of asset classes. It is allocated into 70% equity, 20% income oriented and 10% inflation oriented.

Developed Market Equity – The Developed Market Equity Fund is a low-cost way to gain diversified exposure to global large and mid-sized companies across all 23 developed markets countries, the largest of which is the United States with approximately 65%. Specifically, the fund is passively managed according to a customized S&P Developed Large‐Mid Cap Index with a slight tilt to value securities. This index is very similar to the MSCI World benchmark. Due to its broad diversification, it may be considered a core equity holding in a portfolio.

Emerging Markets Equity – The Emerging Markets Equity Fund is passively managed with the MSCI Emerging Markets index and aims to invest in emerging market countries. Stock of companies in emerging markets tend to be more volatile than those in developed countries, which could imply a greater risk-reward profile.

Domestic Bonds – The Domestic Bond Fund utilizes a core plus fixed-income strategy. This strategy allows the investment team to pursue “plus” sectors like emerging market debt, non-investment grade credits and convertible bonds. The fund is managed according to the Barclays Capital Aggregate Bond Index.

Cash Equivalent Pool – The Cash Equivalent Pool is designed as a money-market investment vehicle.

GuideStone Mutual Fund Family– Additional mutual fund options are available including any in the GuideStone family of funds. GuideStone employs social screens on their funds which are substantially like those used by WatersEdge. Information on these funds can be found here GuideStone Funds®. Please call WatersEdge for additional information.

Customer Service

At WatersEdge, we want your ministries to receive their gifts from you as soon as possible. Our dedicated staff ensures your grant recommendations are distributed within 2-3 business days. Unlike some larger foundations and financial organizations, you will have a designated WatersEdge expert to talk to.

For those DAFs managed by your personal financial advisor, the timeline is dependent upon your advisor. WatersEdge cannot send any money out until your advisor has liquidated an asset and then sent the cash to WE.

Online Platform

WatersEdge has an online platform (through a third-party service) where you can create a donor advised fund, add funds and send grants. You also have the option to view statements, giving history, grant history and more.

What Assets Can Fund This Gift?

- Cash

- Publicly traded stocks and bonds

- Mutual funds

- Real estate

- Many privately held investments

- Private foundation

Advisor Options

If you would prefer for your financial advisor to retain oversight of your funds, WatersEdge has an option to create an Advisory DAF. This option also allows you to have more choices in how your funds are invested. For more information call our Director of Donor Relations, Holly Blakey, at 405-532-2481.

FAQ

1. What are the benefits of having a DAF?

Think of a donor advised fund (DAF) as a savings account for your charitable giving. In many ways, it works the same as a 401k (a savings account for retirement), or a 529 account (a savings account for funding higher education costs). Like any of these savings accounts, they are designed to accumulate in value for the benefit of a future expenditure.

Donor advised funds are simple to open, provide a charitable tax deduction whenever money goes into the account, and are easy to grant/gift money to your choice of 501(c)3 organizations whenever you are ready to do so.

DAFs are meant to simplify a donor’s charitable giving plus add accrued interest, which maximizes your gifts to charity. You get one gift receipt for each contribution to the DAF and can give to several different charities. All you have to do is tell us in writing where you want to give and we handle the rest.

2. What kind of tax deduction comes with a gift to a Donor Advised Fund?

Contributions to your DAF receive immediate tax benefits.

3. How do DAFs generate income?

DAF contributions are invested and grow to maximize impact. All the growth of your initial gift is tax free. On an initial $1,000 DAF gift, your account may grow before your first grant is made.

4. Why are DAFs considered a simple way to manage charitable giving?

All your charitable giving can be channeled through a single fund once you set up a DAF. Once you make the initial gift, you choose which 501(c)3 charitable organizations you want to support and make a “grant” to those organizations. WatersEdge sends the checks and manages the paperwork for you. You will get one receipt for each contribution to the DAF.

5. How do I make a grant?

You can make grants from your online account or send us an email or letter with your grant instructions. As long as we have a written record of your request, your grant will be made.

6. How quickly does the charity receive my DAF grant?

DAF grants are processed within 3-4 days and checks are sent via regular USPS mail.

7. Can I set up recurring grants to be made?

Absolutely. For example, many donors set up a grant to be made to their home church on a monthly basis.

8. What if a DAF has an account balance at the end of the year?

DAF balances will roll over until an account is fully depleted.

9. What happens to the balance of a DAF once a donor passes away?

DAFs have a beneficiary designated for the balance of the fund. They can also have a successor advisor who manages the fund after they are gone. Some donors choose to pass along their legacy of giving through DAFs that are ultimately managed by their children.

Create Your DAF Today

Review Your Giving Options

When you give generously, the details make all the difference. It’s important to keep in mind your family situation, tax considerations and charitable goals.

Make the right choice with a simple side-by-side comparison.